您现在将离开我们的网站并进入不受我们控制的第三方网站。

更新:TD Greystone Target Date Plus基金已添加到Sun Life集团退休服务的核心投资平台

We are pleased to advise that Sun Life Group Retirement Services (GRS) has added the TD Greystone Target Date Plus Series of Segregated Funds to its Core investment platform effective March 1, 2023.

For more details, read the announcement from Sun Life below.

"Date: February 21, 2023

Addition of TD Greystone Target Date Plus Funds to the Core investment platform

Plan sponsors may wish to consider whether this investment news has any implications for the investment options available within their plans. Sun Life Assurance Company of Canada purchases units of the funds listed below, which are established as segregated funds in accordance with the Insurance Companies Act (Canada).

Sun Life Group Retirement Services (GRS) is pleased to announce the addition of the TD Greystone Target Date Plus Series of Segregated Funds (the Funds) to our DC Core investment platform (Core platform). The Funds will be available beginning March 1, 2023.

We are adding the Funds to provide plan sponsors and their members with additional choice in the important Target Date category.

About the TD Greystone Target Date Plus Funds

TD Greystone created the funds in 2014 and the series currently consists of nine funds that range in target maturity from 2025 to 2060, in 5-year increments, and a retirement fund. The Funds are a unique offering on the Core platform, due to their significant allocation to private (non-listed) alternative asset classes. The Funds each invest 20-25% in alternatives, which consist of Canadian and global real estate, global infrastructure and commercial mortgages. This allocation to private alternatives provides additional diversification and comes with unique opportunities and risks. Other target date funds available on the Core platform offer smaller allocations to alternatives that consist primarily of listed securities (i.e. real and infrastructure stocks).

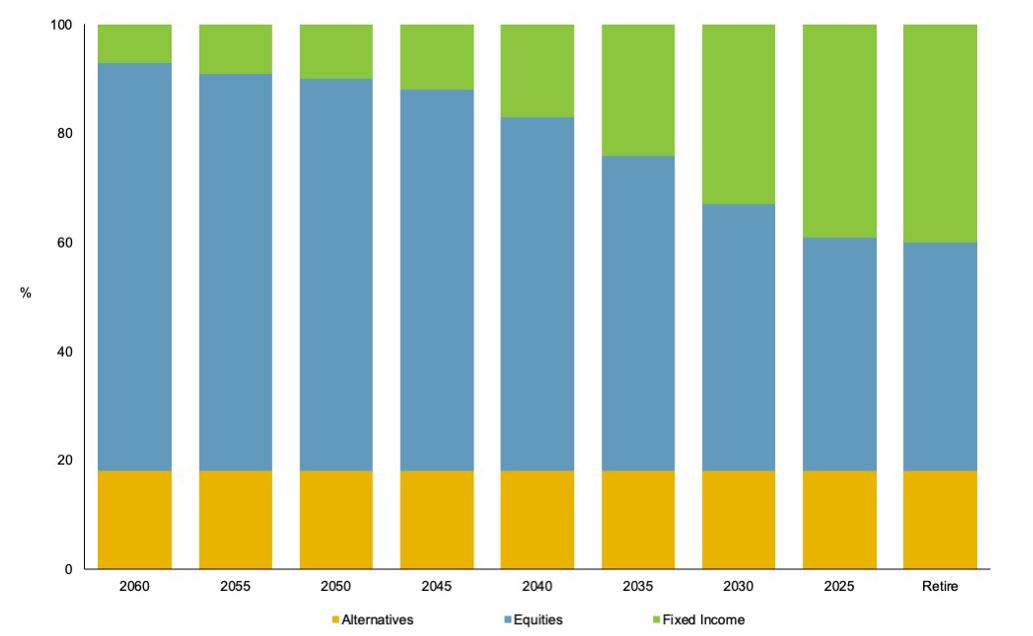

The Funds' objective is to deliver strong long-term returns along with reduced return volatility as their maturity date approaches. To reduce return volatility, as the maturity date nears investments in risker assets (i.e., equities) will decrease, while investments in lower risk assets (i.e., fixed income) will increase. Primary investments include: i) equity, ii) bonds, iii) global & Canadian real estate, iv) infrastructure, and v) commercial mortgages.

The Fund series' glidepath balances market risk with timing (also known as sequence of returns risk) that a plan member faces as they approach retirement. This glidepath shape reduces equity exposure in the funds earlier than most other target date series. TD Greystone believe that the exposure to alternative investments allows this earlier de-risking. The 2060 fund vintage has an asset allocation of approximately 72% equity, 5% fixed Income and 23% alternatives. At maturity, the asset allocation is 41% equity, 34% fixed Income and 25% alternatives. The glidepath does not change after maturity.

TD Greystone is a part of TD Asset Management (TDAM). A four-person Institutional Active Asset Allocation team (IAAAT) manages the funds. They are part of the TDAM Asset Allocation team. 41 investment professionals focus on allocation research, strategy, synthetics and portfolio management make up the broader team.

IAAAT are responsible for designing strategic asset mix, fund selection and tactical asset allocation. They do this for TDAM's active balanced funds, and custom fund-of-fund solutions for institutional investors. The IAAAT team members collaborate amongst themselves as well as the broader Asset Allocation team. This collaboration is embedded through all aspects of the team's investment process.

The Funds currently invest in 15 underlying funds, all managed in-house. The underlying funds are primarily actively managed. The following are the permitted asset allocation ranges for all Funds in the series.

| 资产类别 | Minimum % | Maximum % |

| Cash & Short-Term Equivalents | 0 | 10 |

| Canadian Nominal Bonds | 0 | 60 |

| 股票 | 15 | 80 |

| Global Bonds | 0 | 15 |

| 实际收益公债 | 0 | 10 |

| 高收益债券 | 0 | 15 |

| 房地产 | 0 | 20 |

| TD Greystone Real Estate Fund LP | 0 | 20 |

| TD Greystone Infrastructure Fund LP | 0 | 20 |

| TD Greystone Mortgage Fund | 0 | 20 |

The Funds’ Statement of Investment Policies and Procedures (SIPP) are available on the plan sponsor website.

Below is an illustration of the glidepath."

Should you have any questions, please contact your TD Global Investment Solutions Relationship Management Team.

本文所包含的信息仅供参考。信息出自我们认为可靠的来源。本信息并未提供财务、法律、税务或投资建议。具体的投资、税款或交易策略应根据每位投资者的目标和风险承受能力加以评估。所有产品都存在潜在风险。 Important information about the pooled funds is contained in their offering circular, which we encourage you to read before investing. 请获取副本。所显示的回报率为基金的历史年度复合总回报率,包括单位价值变动和所有分红再投资。所有基金的收益率、投资回报率和单位价值都会波动。所有绩效数据仅反映过去的回报,未必能准确反映未来的表现。 Pooled Fund units are not deposits as defined by the Canada Deposit Insurance Corporation or any other government deposit insurer and are not guaranteed by The Toronto-Dominion Bank. Investment strategies and current holdings are subject to change. TD Pooled Funds are managed by TD Asset Management Inc. Management fees and expenses all may be associated with mutual fund investments. 请在投资前阅读基金概况和招股说明书,内附详细的投资信息。互惠基金不受到保证或保险,其价值经常变动,而且过往表现可能无法再现。互惠基金策略和当前所持资产可能会有变动。本文档中的部分陈述可能包含预测性的前瞻性陈述(“FLS”),其中包含“预计”、“预期”、“打算”、“认为”、“估计”和类似的前瞻性表述或其否定形式。前瞻性陈述基于当前对未来普遍的经济、政治、相关市场因素(例如利率和汇率、股票和资本市场)以及普遍经营环境的预计和预测,并假定不发生税法或其他法律或政府管制方面的任何变动或灾难事件。对于未来事件的预计和预测本身受无法预见的风险和不确定性的影响。此等预计和预测可能在未来并不准确。前瞻性陈述并非对未来表现的保证。实际发生的事件可能与前瞻性陈述明示或暗示的事件存在实质差异。包括上文所述各项因素在内的多个重要因素均可能造成这种背离。您不应在任何程度上依赖于前瞻性陈述。道明互惠基金和道明资产管理计划投资组合由道明银行 (Toronto-Dominion Bank) 全资子公司道明资产管理有限公司 (TD Asset Management Inc.) 管理,并通过授权经销商销售。TD全球投资方案代表道明资产管理有限公司 (简称“TDAM”) 和Epoch Investment Partners, Inc. (简称“TD Epoch”)。 TDAM and TD Epoch are affiliates and wholly owned subsidiaries of The Toronto-Dominion Bank.

® TD标志和其他TD商标为道明银行或其子公司的产权。

Related content

More by this Author